BANK RECONCILIATION IN DYNAMICS AX AND D365: INTEGRATION STANDARD 43

Security in the tracking of your bank transactions is essential for the peace of mind of your company’s managers. Any existing movement in the company’s bank accounts must be correctly reflected and matched with the bank transactions of your ERP in Dynamics. This situation, moreover, will guarantee total transparency of your actions with your internal and external audits, and even with your shareholders, as the case may be.

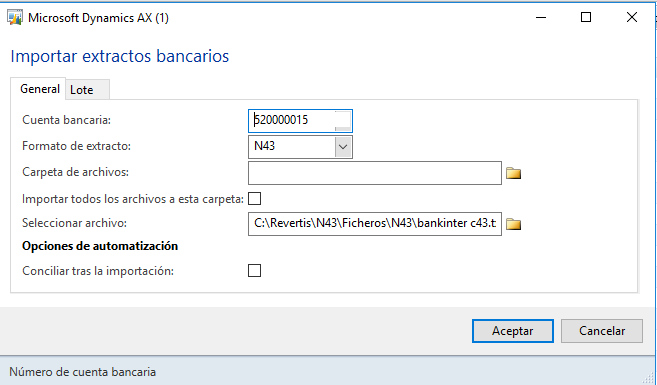

In order to ensure and facilitate these actions, from REVERTIS we put at your disposal our automatic module of bank reconciliation, developed for all the versions of AX from 4.0 to D365 FINANCE. This reconciliation is based on the integration of the N-43 file, as dictated by the CSB (banking high council) in its Norms of the Spanish Banking Association (AEB), but taking advantage of the current standard functionalities of Dynamics AX and D365.

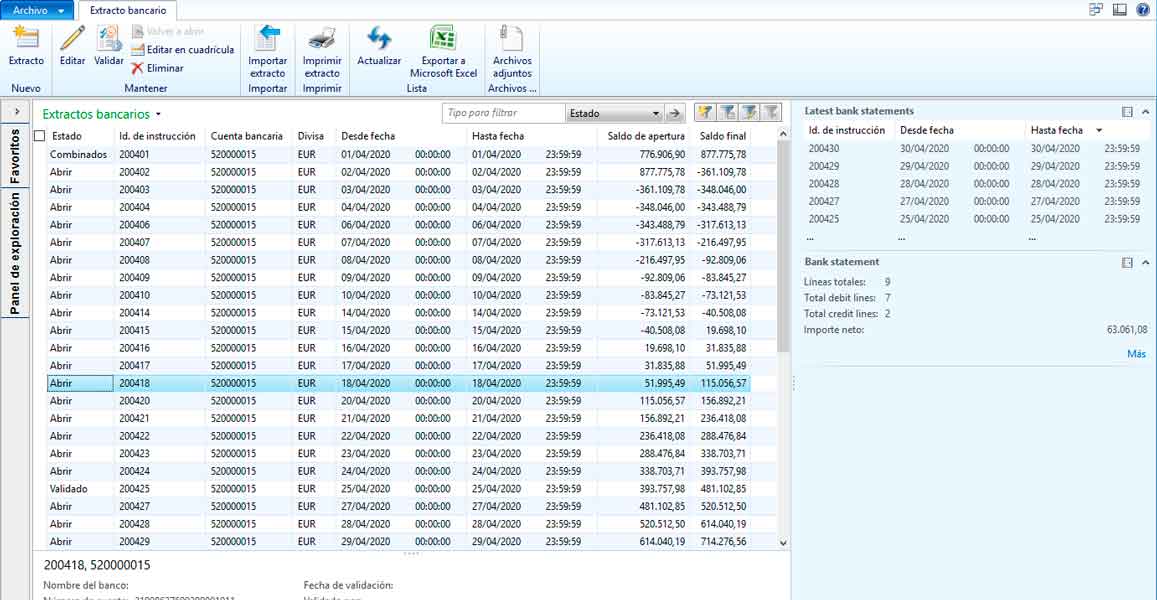

Our bank reconciliation utility goes beyond the reconciliation itself and allows you to have directly in your ERP the information of bank statements and bank movements. In this way you will avoid having to consult the bank’s website over and over again.

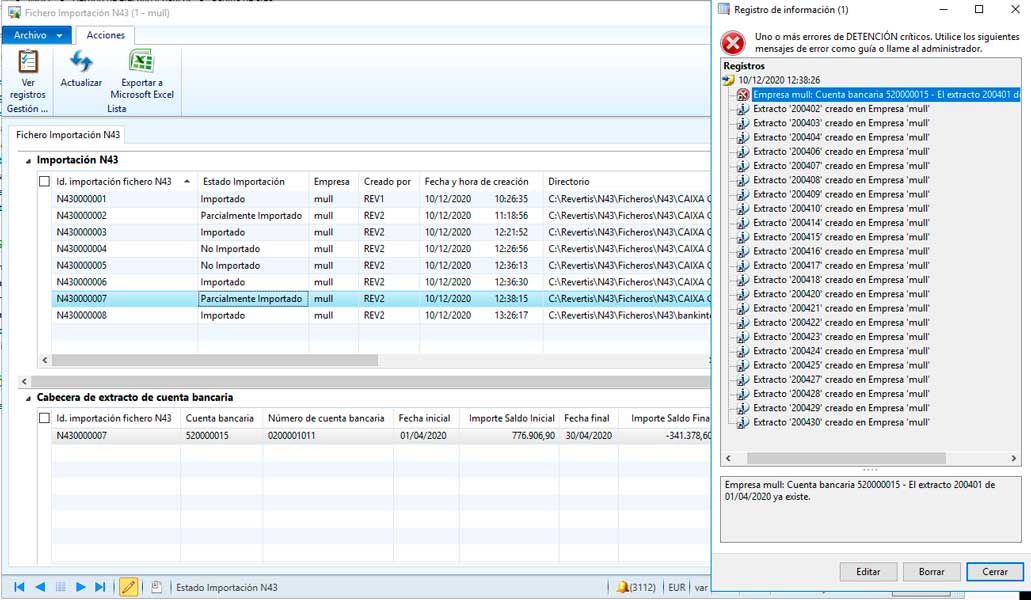

We complement the operation with traceability information that allows you to track the use of the system. You will know how many times this function has been used and the results obtained in each of the different executions.

Main benefits:

- Operational transparency. You will have total security and guaranteed traceability in the use of the system, being able to know how many times the process has been executed and the results obtained in each of the different executions.

- Adapted to the Spanish regulations in use (N-43). The standard system works with the DMT 940 standard, but many national entities prefer to use the 43 standard.

- Highly automated process with access to daily statements and bank movements directly in Dynamics AX and D365. You will reduce the time spent consulting bank movements, as they will be directly available in Dynamics, and you will have tools to reconcile movements in a highly automated way.

Ease and Security

Through our utility, you can decide how often you want to perform the reconciliation (monthly, weekly or even daily, if necessary) and you can automate a good part of the process so that manual intervention in this task is minimal.

We also record a traceability record that allows you to consult the number of times the reconciliation action has been performed and the result of each of these. This information will also allow you to manage with your bank any possible problem that may arise from the N-43 file integration process, while at the same time allowing you to properly document all these actions for auditing purposes.

Thus, we detect that no erroneous or duplicate files are being integrated and that the movements actually correspond to the bank accounts in the system.

Standard integration

We leverage the standard processes integrated in Dynamics to provide a view of daily bank statements directly in Dynamics. This functionality makes it much easier to access bank transactions directly in Dynamics and reduces your daily actions.

You no longer need to open the bank’s website each time, enter authentication credentials and navigate through different interfaces in order to view a particular transaction.

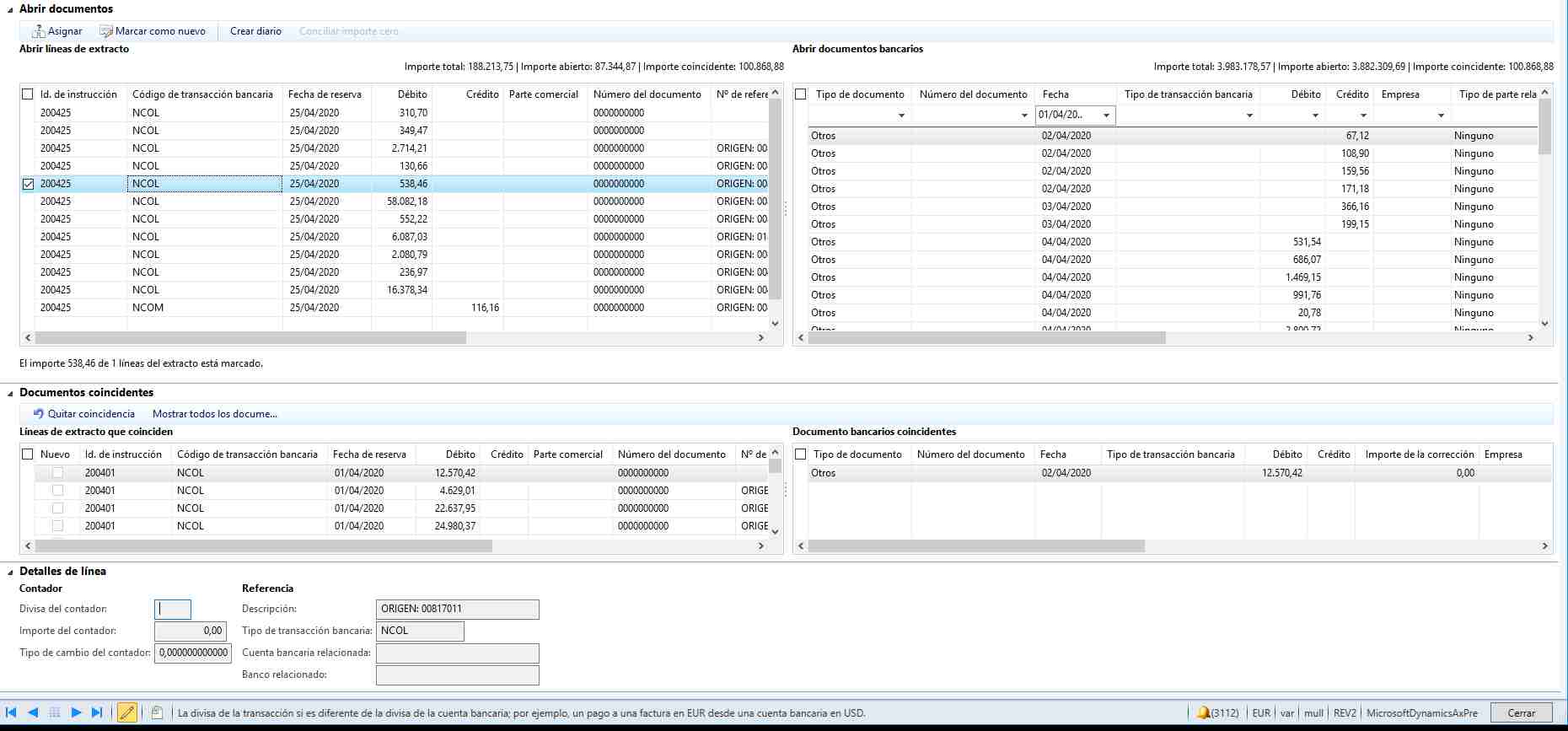

Within the standard reconciliation journal itself, we have added a series of additional utilities that allow you to reduce the time required to reflect in Dynamics those bank movements that had not yet been recorded in the application (typical cases of certain expenses such as some commissions, notary procedures, etc. ….). We can also eliminate certain transactions from AX banks that may be due to error movements and compensate each other.

Automation of the bank reconciliation

The bank reconciliation is performed in an automated way, so that the system is able to relate as many bank movements as possible with their respective Dynamics bank account transactions. These reconciliations are performed in waves, so that the first one is the most restrictive (coincidence of amount, date, concept, etc.) and the following ones, usually apply a more or less loose margin (more/less days of difference, etc.), depending on the situation of the information presented by each company. In specific cases, we can even apply certain reconciliation rules that allow us to associate a bank movement with the sum of several transactions in the Dynamics bank account and vice versa.

The movements that have not been possible to reconcile automatically, remain pending for review and manual reconciliation, if applicable. In case they correspond to movements that cannot be reconciled yet (because they are transactions that have been registered in Dynamics with a date in the future, for example), they will remain pending for future reconciliations and will be properly identified in the bank balance report to obtain the correctly squared daily balance.

Results

To finalize the process, we present a series of forms that allow you to obtain both the daily bank statements and the results of the reconciled/pending bank transactions, as well as their direct export to Excel to deepen or customize the analysis of these if necessary.

Our solution is working in several companies nationwide. Do not hesitate to ask us for a demonstration.