Tax Calculation and Reporting with D365 Finance

Taxes in D365 Finance and Operation

Tax management is an integral part of an ERP. The requirements for calculating and reporting taxes differ significantly from country to country. Therefore, the functionality of a tax module in a truly international ERP system must be comprehensive.

D365 Finance’s tax module allows you to define a flexible and multidimensional tax configuration using tax codes, tax groups and item tax groups, as well as to cover the formal reporting and declaration needs required for any administration. The tax module has been designed with emphasis on taxes on sales and purchase transactions, but it can process many other types of taxes and duties: DUA’s, IRPF’s, ISP’, RE’s, Plastics tax, etc.

Tax Code, Tax Groups and Item Tax Groups

The core elements of the tax module are its tax codes. These codes contain all the logic necessary to calculate a tax on a given transaction, determine the accounting account to which the tax should be recorded, and identify the tax authority to which the tax should be reported and paid.

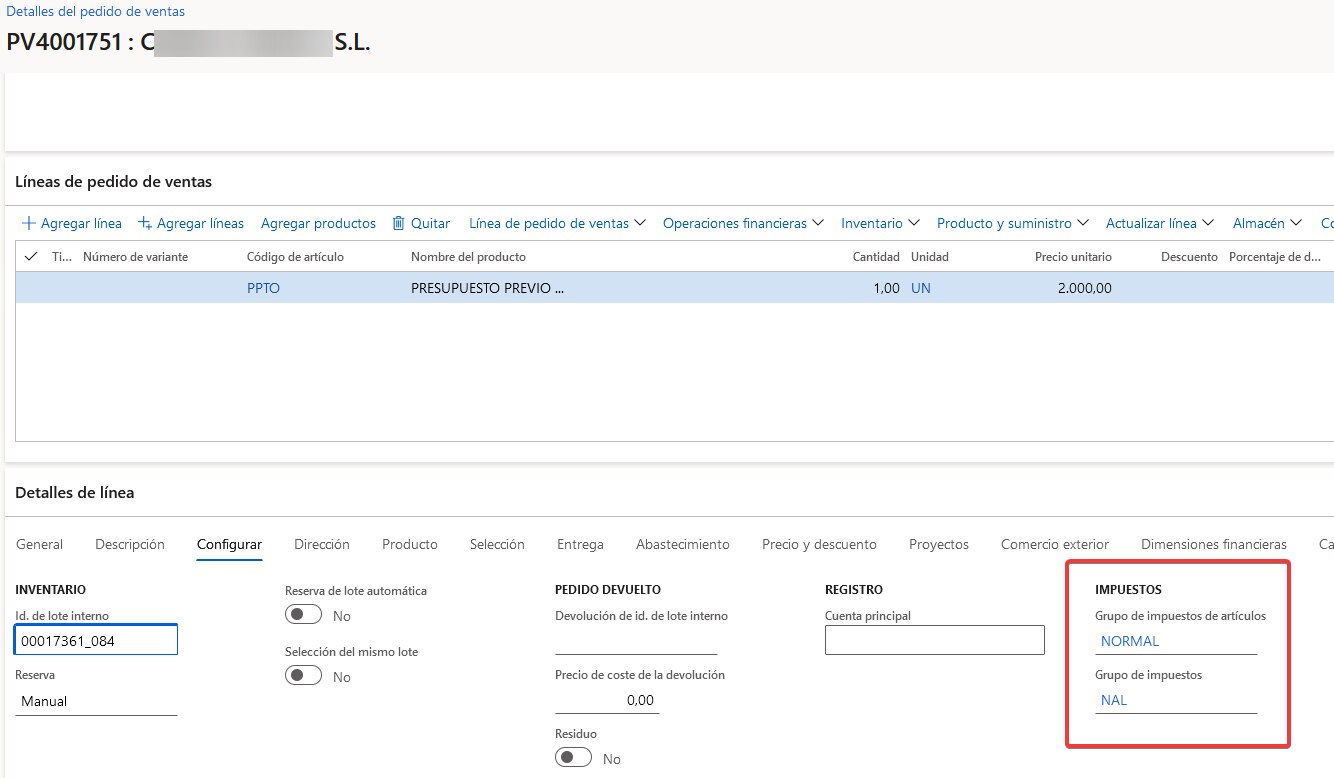

The set of taxes to be calculated for a given transaction is established by two parameters: the tax group and the item tax group. These two dimensions determine all applicable taxes for a given transaction, as in some cases it may be necessary to apply more than one tax simultaneously (e.g. in Spain, VAT + IRPF, VAT + RE, etc…) . Country-specific taxes and the logic for calculating and reporting them are linked to the country context of a legal entity.

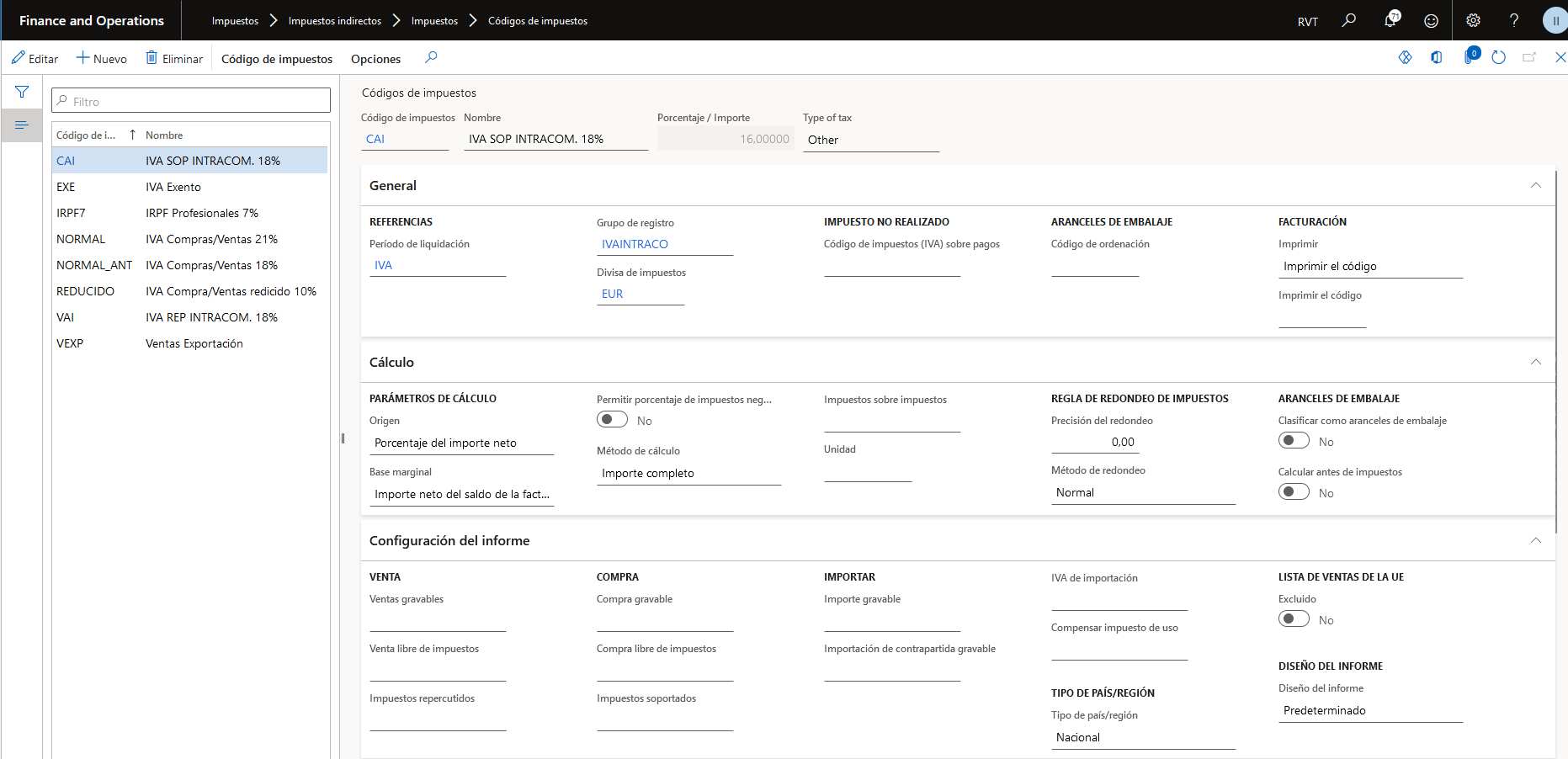

Tax Code

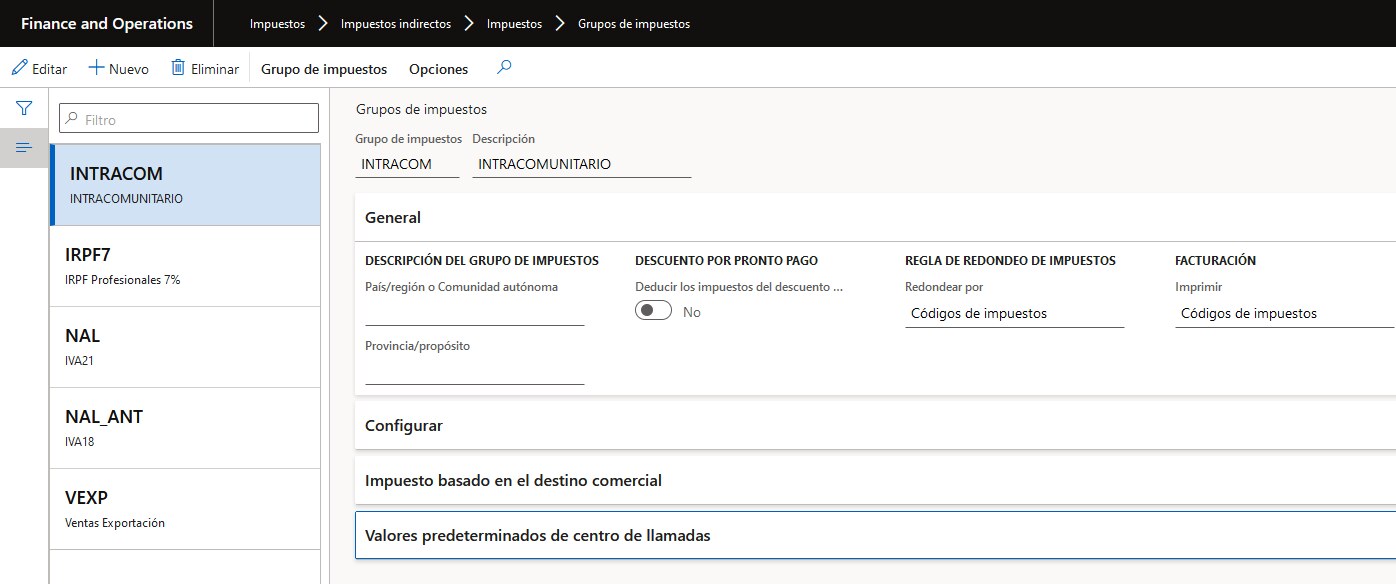

Tax groups

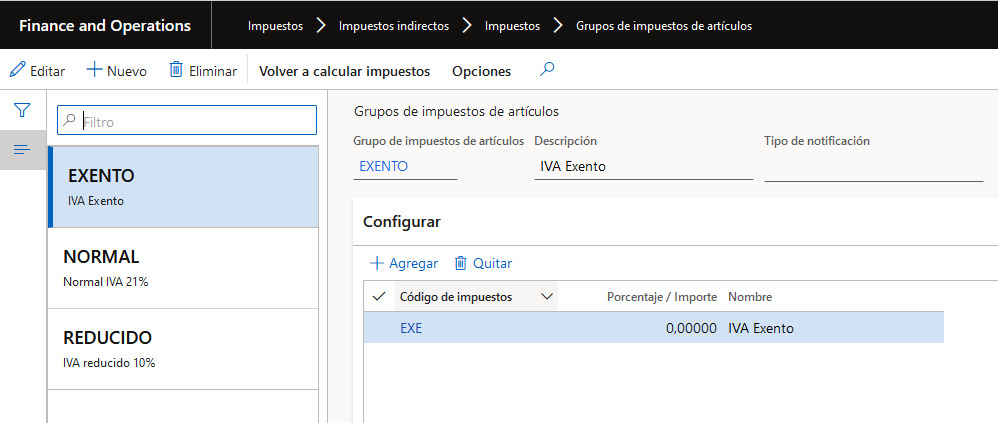

Item Tax Groups

FLEXIBLE TAX CONFIGURATION

An unlimited number of tax codes can be configured and an extensive set of control parameters can be used to specify detailed calculations, including:

- Line or invoice based calculations.

- Tax or rate per unit.

- Tax calculated as a basis for other taxes.

- Conditional or unrealized taxes.

- Date and/or amount dependent tax rates.

- Use tax for the United States and reverse charge tax for the European Union.

- Tax exemption codes.

- Manage specific taxes of a community within a country such as the Canary Islands, Basque Country etc.

DETERMINATION OF TAXES

Tax codes are grouped into tax groups and item tax groups, which can be linked to various data entities in D365 Finance, such as customers, vendors, products and accounts. The intersection of tax groups and item tax groups determines the set of tax codes that will be used to calculate specific taxes. After being calculated, the taxes are recorded in a transaction, such as a journal line or a document line. To allow for exceptional scenarios, authorized users can manually overwrite the preset and default tax groups.

COUNTRY-SPECIFIC TAX RETURN

D365 Finance provides country-specific tax functionality and tax reporting for all supported countries. Legal entities in all countries are required to periodically calculate tax liability and generate their own set of tax returns and reports to provide tax information to the government tax authority. D365 Finance supports both the printing of legally compliant tax returns and reports, as well as complex electronic filing processes, depending on the country context of the legal entity.

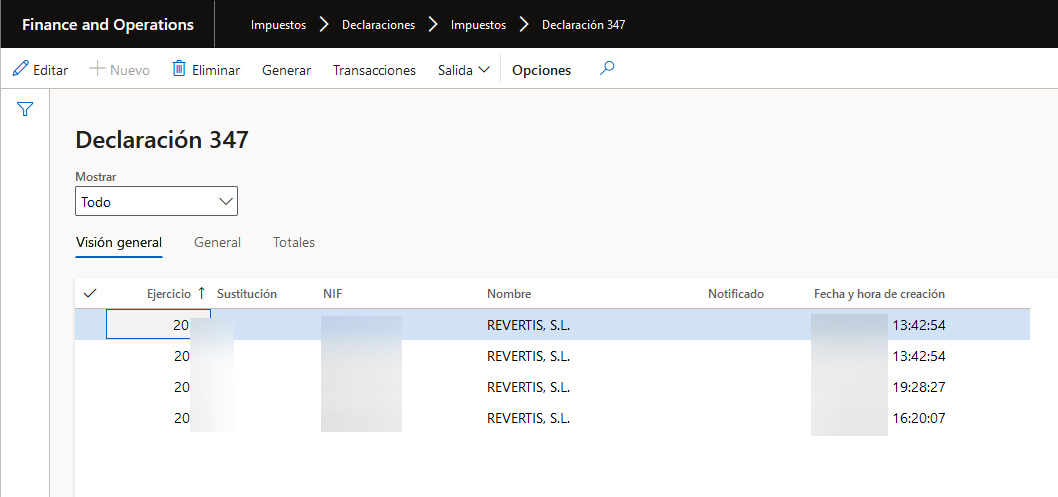

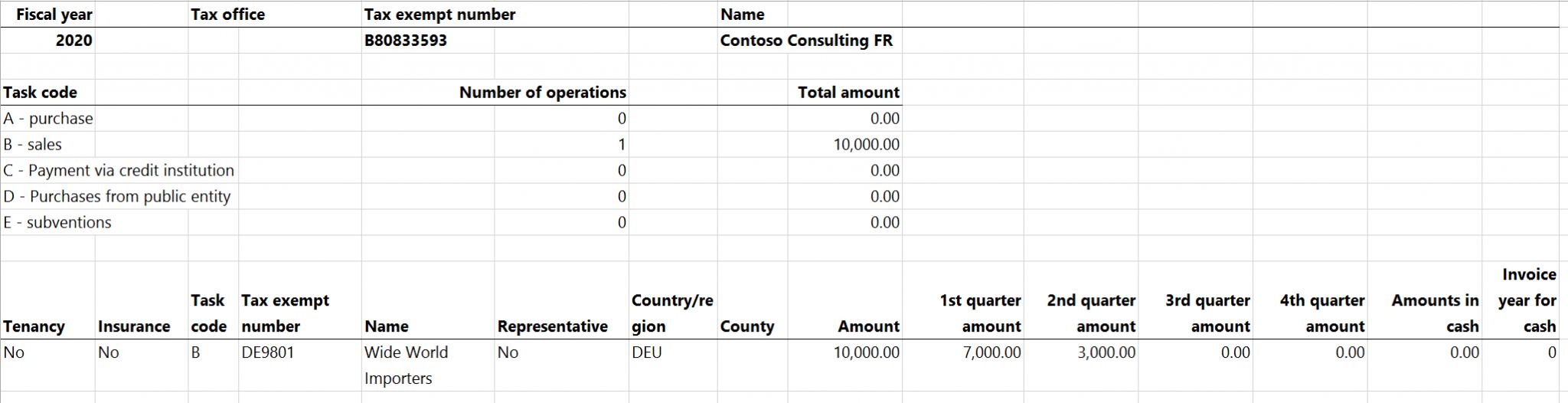

Form 347

D365 Tax Module Overview

The requirements for calculating and reporting taxes differ greatly from country to country. Therefore, the tax management capabilities of an international ERP system must be comprehensive. D365 Finance can provide your organization with the features and flexibility it needs to handle complex international tax scenarios, including: Sales taxes, such as VAT and GST.

Percentage calculations. Fixed tax amounts. Taxes calculated as a basis for other taxes. Reverse charge tax for the European Union; Use tax for the United States. Tax exemptions. Packaging duties. Multiple tax rates dependent on date or amount. Flexibility of deadlines and tax authorities. Country-specific tax reporting.