Nowadays, it’s very easy to perform an internet search and ask for the differences between D365 Business Central and Dynamics 365 Finance. Both Copilot and Chat GPT are happy to provide technical comparisons. So why are so many clients unsure which one to select? We are going to give you our point of view from the perspective of a consultancy that works with both products. Revertis has experience with both products and knows very well how far each one goes.

Our focus will not be on technicalities (which are the easiest to find on the internet) but rather trying to explain why to lean towards one solution over the other.

Origin of the two solutions

To explain why Microsoft has two products in its portfolio instead of just one with versions, we have to go back to the products’ origins. We already know the saying, “Those who do not know history are doomed to repeat it.”

D365 Business Central is the Cloud evolution of Navision.

D365 Finance is the evolution of Dynamics AX, or also AXAPTA.

As has happened before, when Microsoft wants to enter a market, it buys an existing product. This was the case when it wanted to enter the ERP world. Microsoft acquired a company that already had both products in its portfolio, Navision and AXPATA.

Each one had a different origin and used different technology. Originally, D365 Business Central was a more mature product implemented in a large number of companies, while Dynamics AX was a star product, very recent, and with a much more open and innovative technology and work philosophy.

Nowadays, the message to offer one product or another based on the company’s size is quite common. At Revertis, we think there are more parameters to take into account, as we can find very large companies that are managing perfectly with BC and, conversely, companies with few employees that handle D365 Finance in a very agile and effective way.

Cost comparison: D365 Finance vs D365 Business Central

We cannot ignore the cost of both solutions.

D365 Finance has a minimum of 20 licenses, whereas this restriction does not apply to D365 Business Central.

Therefore, the cost of the D365 Finance solution is difficult to justify when the client has a reduced volume of users/licenses.

So, does turnover volume influence the evaluation of both solutions? In this respect, there is no clear figure.

A company can have numerous employees, invoice 50 Million euros a year, buy a single product for €10,000.00, and sell it for €20,000.00 to very few customers. In this example, it seems obvious that it doesn’t need a complex system to manage its business. Another client may have a turnover of 6 Million euros, few employees, and a complex manufacturing process, purchase of raw materials indexed to the stock market price, international distribution, thousands of customers, etc. We see that the situation of the two companies is totally different from a complexity point of view, and therefore the information technology solutions to be applied will necessarily be very different.

At Revertis, we evaluate each client’s situation more based on the business’s information technology situation and needs rather than on economic volume.

Therefore, the cost of licenses, while a parameter to consider, should not be the sole determining selection factor.

When D365 Business Central is right for me

At Revertis, we advise companies that have a relatively simple business with controlled growth to lean more towards D365 Business Central. The solution is very complete. D365 Business Central can be easily customized to bridge the gap that may exist between your needs and the standard version, but generally, the installations where we usually apply BC tend to require few modifications.

We often hear talk of a “Vertical” for a type of business in D365 Business Central. The vertical should generally be interpreted as a series of specific adaptations for a particular sector, encapsulated in a package that must be acquired, installed, and maintained separately.

At Revertis, we promote working with the original product to avoid greater dependencies.

When D365 Finance is right for us

We steer towards a D365 Finance solution when some of the following factors are present:

- Your company has an expanding business, with high growth forecasts.

- You have complex manufacturing, distribution, or service management processes.

- You need to automate common processes repetitively.

- You require adapting business cycles and technologies to your specific business processes in a very concrete way.

D365 Finance gives you more control over your resulting information technology environment.

As an example, we can compare the differences in financial management between the two products

Business Central: Offers basic accounting, simple budgets, and up to 8 financial dimensions.

Finance: Includes advanced budget control, analytical accounting with cost distributions and complex accounting allocations, extended Fixed Asset Management and CMMS, unlimited financial dimensions with dependency hierarchies and application/restriction rules between them…

From a usability perspective, you will also find in D365 Finance access more geared towards information entry by multiple users simultaneously, greater flexibility in recording journals and financial collection and payment operations, as well as in general journals, and access more oriented towards presenting summarized information, avoiding the use of reports.

For its part, BC incorporates a very useful on-line information analysis facility, through its “analysis mode” tool, built into all transaction entry screens.

There is no clearly defined criterion for leaning towards one solution over the other. Therefore, we believe it is important to select a Partner that has extensive experience in both products, as is the case with Revertis. At Revertis, we are capable of detecting your needs and guiding you towards one solution or another. More than 20 years of experience with exclusive dedication to Microsoft environments back our ability to advise clients.

At Revertis, we are aware that selecting a new ERP is a crucial decision that will affect the company’s future in the long term. Moving from D365 Business Central to D365 Finance or vice versa is not done through a simple license change or an update. It is a complex project. For this reason, it is very important to select the product well from the start.

Revertis can help you make the right decision. The investment you make in the ERP must allow the company to grow by relying perfectly on its information system. This system must accompany you and help you evolve. In no case should the system condition your business decisions or your growth.

With a Partner like Revertis, you can be sure of selecting the right product for your business and setting aside your technological worries for good.

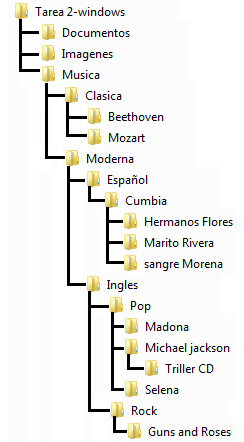

Whether your files come from a file server, from Dropbox, or from any system, we almost always find a vertical folder structure. Users with experience in office software (I include myself in this group) have gotten used to having our folder tree well organized. On many occasions, to reach our file we have to “open” four or five folders.

Whether your files come from a file server, from Dropbox, or from any system, we almost always find a vertical folder structure. Users with experience in office software (I include myself in this group) have gotten used to having our folder tree well organized. On many occasions, to reach our file we have to “open” four or five folders.

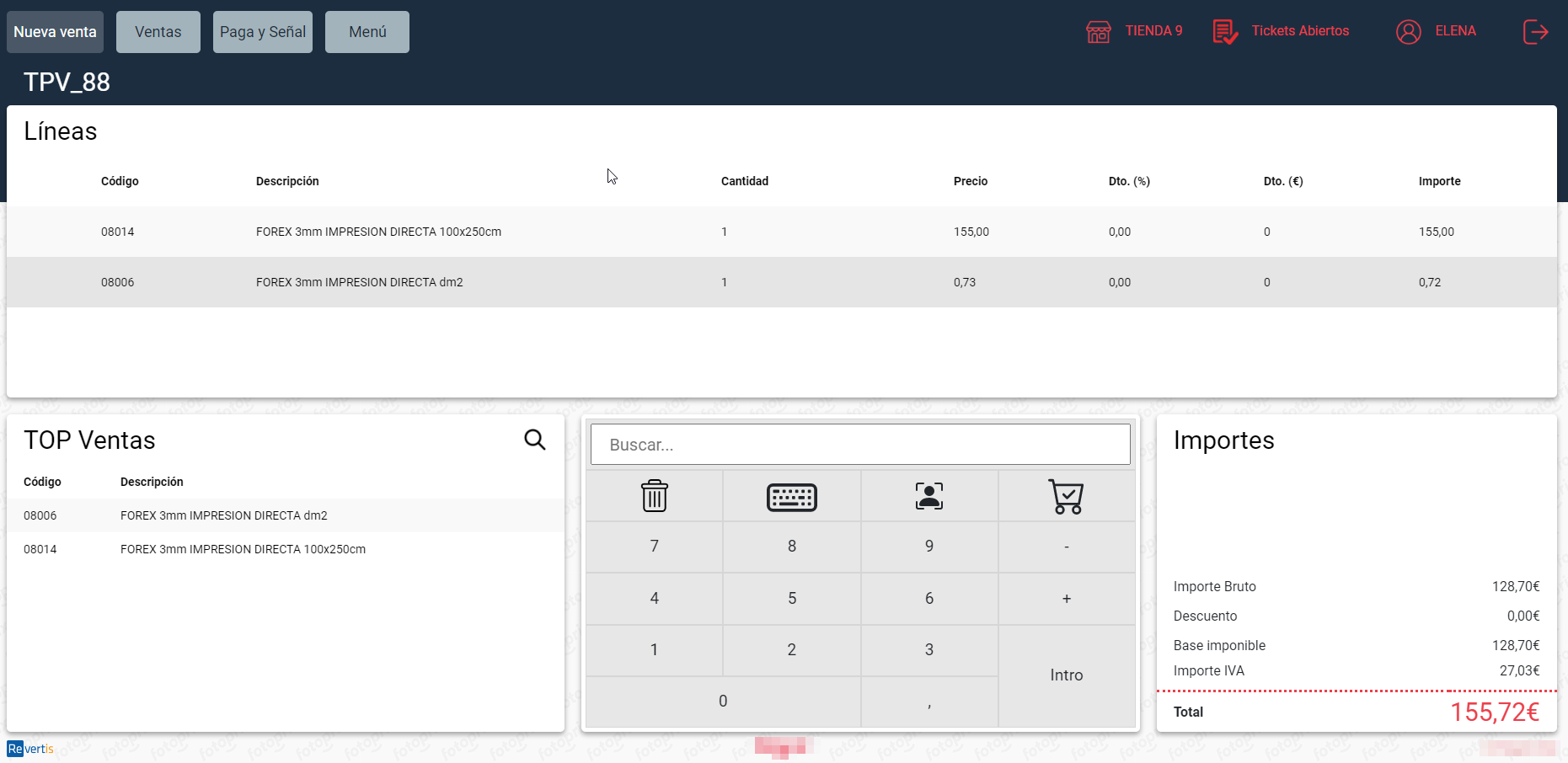

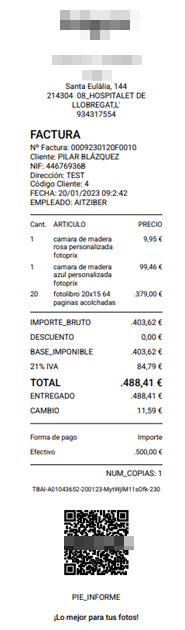

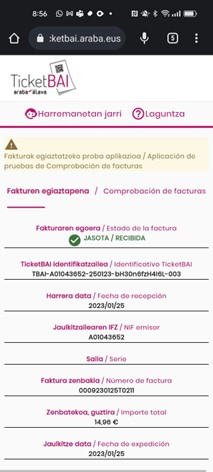

The final objective is that the client/consumer can check at the moment that his purchase operation (sale for the company/trade) is legal and is declared in the Treasury. For this purpose, on the sales receipt, we show the TBAI Code and the QR code that will direct you to a specific web page of the Tax Authorities in order to verify the correct registration of this sale.

The final objective is that the client/consumer can check at the moment that his purchase operation (sale for the company/trade) is legal and is declared in the Treasury. For this purpose, on the sales receipt, we show the TBAI Code and the QR code that will direct you to a specific web page of the Tax Authorities in order to verify the correct registration of this sale.